Advances in technology have shifted the traditional linear selling process between seller and buyer to a non-linear process involving many actors. For instance, according to Gartner, there could be up to 7 decision-makers involved in deals +$500K on the buyer side, plus several other people on the seller side.

On the other hand, communication advances and work specialisation has allowed non-traditional actors to engage in selling. These have blurred the intra-company divide between sales and other functions as well as enabled external actors to act as selling agents. Evidence of this development is the flurry of customer reviews and testimonials that have now become a fixture in sales conferences and company´s portals. Journalists and social media influencers exert a powerful effect on prospective buyers. Recent research by Forrester indicates that 97% of IT buyers rely on peer recommendations, ratings, and reviews when procuring software.

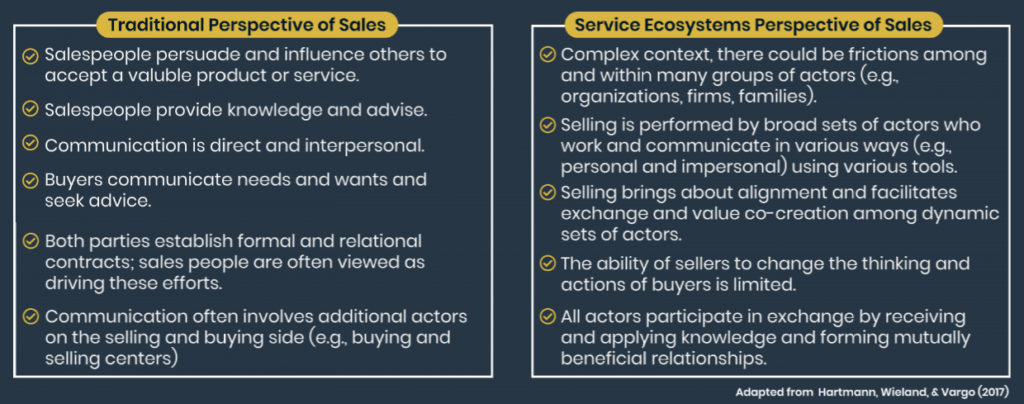

The above trends call for a more holistic approach to selling. Hartmann, Wieland, & Vargo (2017) offer a service ecosystem perspective that expands the buyer-seller process to a systemic view with multiple players co-creating value and influencing their context. The shared value assumptions, regulations, culture, and routines that guide the service exchanges and interactions among different players are dynamic; they can be created, maintained and disrupted.

The arrangement of institutional factors can go from complex discrepancies (i.e. a new value proposition such as the emergence of Cloud software a few years ago) to simple day-to-day adjustments (i.e. routinised sales processes such as re-ordering).

Transitioning from institutional arrangements (i.e. Client-server to SaaS solution) requires a thick crossing point to change the current expectation of multiple actors such as IT personnel, industry experts and other market players. As the institutional factors are re-aligned and relationships optimised, the crossing points (service exchange) becomes thinner and thinner until the service/product is commoditised.

Institutional arrangements are shaped by stories (i.e. email, brochures, sales presentations, models, etc.) that enable and constrain co-creation practices and become embedded in broader discourses. These narratives are essentially sense-making tools that would come into alignment to form a communication infrastructure.

Implication 1: Consider your Sales Process before developing new Products or Services

The first implication of this view is that, for new products, managers need to think carefully about Sales processes before a new product or service is even developed. If a new solution fits well into an established market with thin cross points, then it will require less selling effort, with the downside of an overcrowded market. Hence, more likely you will need to compete on price, requiring a very lean organisation or overreliance on partners to go to market. On the other hand, if the new solution faces a thick crossing point, managers will require a sophisticated sales force to negotiate institutional resistance and drive change. In these cases, trust and relationship management would be critical skills for your sales force.

Implication 2: Align your sales force´s expertise to your crossing

A second implication is how this view helps us understand the existing business. If you have an established product or service, then you should focus on deepening the relationships with your current customers and leverage their reference and trust. This will minimise frictions that could lead to the discovery of alternative solutions.

Overall, this framework helps you assess under which crossing you are operating, and consequently evaluate if your sales force matches the required expertise. For instance, in thick crossing points, your salespeople need skills, knowledge and ability (KSA) to marshal internal resources and engage with a broader set of external actors. An important consideration would be how to measure performance and the sales cycle timing for fruitful results. We argue that leading indicators could help manage short, medium- and long-term effects.

Implication 3: Create a communication platform to engage all relevant players

A third implication would be the creation of narratives infrastructures (i.e. dialogue platforms) to integrate and manage the communication flows of all actors involved in your sales process. On here, the convergence of CRM technology, Artificial Intelligence (AI) and Machine Learning are essential to tracking a broader set of players and developing strategies to assess their influence, opinions and recommendations. For instance, AI eliminates manual data entry and can detect irregularities, anomalies, duplicates, and other errors that compromise CRM data. We will talk about this in more detail in next month´s article.

Implication 4: Adapt your Sales Methodology and Salespeople´ behaviour

A fourth and final implication is the impact on your current selling methodology to incorporate a broader set of actors. This new reality complicates the sales cycle and affects the way to build relationships. Sales Managers need to drive their salespeople to see their role as architects for change within their customer/prospects’ world. In the coming months, we will expand on how change management principles can guide the overall organisation to successfully removed buyers’ barriers to purchase and maximise purchase ease.

We have created an Infographic that summarises this approach. Both sales perspectives are compared below.

Receive our latest insights